Abit 6a69ra1r driver download for windows 10 pro. Easy Setup with USB Adapter. Free Download of 1-Wire Drivers and OneWireViewer Demonstration Software. Compatible with Other 1-Wire Devices Purchased. Separately (DS2411, DS2432, DS28E01, DS2502, DS2505, DS2405, and DS2406) Ordering Information. Rev 4; 8/09. EPROM devices, such as the DS2502 and DS2506.

- Drivers Maxim Integrated Products USB Devices

- Drivers Maxim Integrated Products Usb Devices Type C

- Drivers Maxim Integrated Products Usb Devices Download

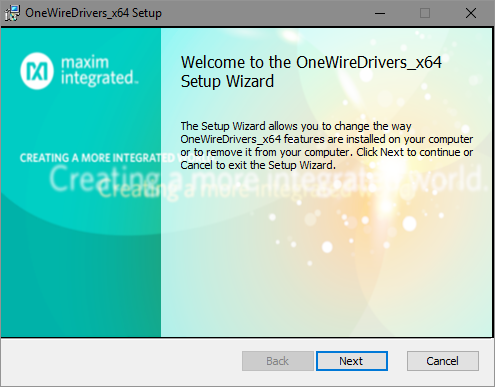

The DS9090K provides the hardware and software necessary to evaluate and operate 1-Wire > QTYDESCRIPTION products in an easy-to-use PC environment. All 1-Wire EEPROM, EPROM*, and ROM devices are readable with the DS9090K. All 1-Wire devices with memory or PIO/switches can be written with the DS9090K except 1-Wire EPROM devices*. In this way, the engineer can evaluate 1-Wire chips for potential design purposes or support end-product development activity. Kit operation requires a host PC. Demonstration software consists of the OneWireViewer (a JavaΙ program). For 32-bit and 64-bit Windows operating systems, the OneWireViewer comes as part of the 1-Wire Drivers install package. For other operating systems, refer to the online version of the OneWireViewer. 1 PCB: 1-Wire Device Evaluation Board 1 RJ11 male to RJ11 male cable, 7ft 11-Wire USB adapter with RJ11 Maxim DS9490R# 164-bit silicon serial number (3-pin TO92) Maxim DS2401+ 11-Wire addressable switch (6-pin TSOC) Maxim DS2405P+ 11-Wire dual-addressable switch plus 1kb EPROM memory (6-pin TSOC) Maxim DS2406P+ 11-Wire dual-channel addressable switch (6-pin TSOC) Maxim DS2413P+ 11024-bit 1-Wire EEPROM (3-pin TO92) Maxim DS2431+ > PART TYPE 14Kb 1-Wire EEPROM (3-pin PR-35) Maxim DS2433+ DS9090K# EV kit > # Denotes a RoHS-compliant device that may include lead that is exempt under the RoHS requirements 14096-Bit Addressable 1-Wire EEPROM with PIO (on EV kit) Maxim DS28E04S-100+ > . 120Kb 1-Wire EEPROM (3-pin TO92) Maxim DS28EC20+ > IBM-Compatible PC Running Windows Vistaή, Windows XP SP2, 2003, or 2008 1 Package of 11 2-pin shunts for jumpering Spare USB Port on the PC > *EPROM devices, such as the DS2502, DS2506, etc., requireadifferent adapter (DS9097U-E25) to perform an EPROM write. This adapter can be purchased separately and requires a +12 V p ower supply and a 2 5 -pin to 9-pin serial port adapter (refer tothe adapters data sheet for details). 1-Wire EPROM devices are available to be sampled (up to quantity 2). 1-Wire is a registered trademark of Dallas Semiconductor Corp., a wholly owned subsidiary of Maxim Integrated Products. Windows and Windows Vista are registered trademarks of Microsoft Corp. Java is a trademark of Sun Microsystems. 1 of 8 REV: 042208 >

Open the catalog to page 1Home > News > Top Stories

- Maxim Integrated offers a variety Interface Devices and Interface Integrated Circuits for interconnection, signal translation, voltage protection. Find guides, product specs, videos and more.

- Overcome the challenges of implementing USB-C Power Delivery (PD) with the MAX77958 USB-C PD controller and the MAX77962 28W buck-boost charger recently introduced from Maxim Integrated Products. As portable devices add new technologies such as 5G connectivity and 4K video, many are changing from single-cell to two-series (2S) cell architectures.

Combined company valued at over $68 billion, with total combined revenue of $8.2 billion

Analog Devices and Maxim Integrated Products have announced that they have entered into a definitive agreement under which Analog Devices Incorporated will acquire Maxim Integrated Products Incorporated in an all stock transaction that values the combined enterprise at over $68 billion. The transaction, which was unanimously approved by the Boards of Directors of both companies, will strengthen ADI as an analog semiconductor leader with increased breadth and scale across multiple attractive end markets.

Under the terms of the agreement, Maxim stockholders will receive 0.630 of a share of ADI common stock for each share of Maxim common stock they hold at the closing of the transaction. Upon closing, current ADI stockholders will own approximately 69 percent of the combined company, while Maxim stockholders will own approximately 31 percent. The transaction is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

Today’s exciting announcement with Maxim is the next step in ADI’s vision to bridge the physical and digital worlds. ADI and Maxim share a passion for solving our customers’ most complex problems, and with the increased breadth and depth of our combined technology and talent, we will be able to develop more complete, cutting-edge solutions, said Vincent Roche, President and CEO of ADI. Maxim is a respected signal processing and power management franchise with a proven technology portfolio and impressive history of empowering design innovation. Together, we are well-positioned to deliver the next wave of semiconductor growth, while engineering a healthier, safer and more sustainable future for all.

For over three decades, we have based Maxim on one simple premise – to continually innovate and develop high-performance semiconductor products that empower our customers to invent. I am excited for this next chapter as we continue to push the boundaries of what’s possible, together with ADI. Both companies have strong engineering and technology know-how and innovative cultures. Working together, we will create a stronger leader, delivering outstanding benefits to our customers, employees and shareholders, said Tunç Doluca, President and CEO of Maxim Integrated.

Upon closing, two Maxim directors will join ADI’s Board of Directors, including Maxim President and CEO, Tunç Doluca.

Compelling Strategic and Financial Rationale

- Industry Leader with Increased Global Scale: The combination strengthens ADI’s analog semiconductor leadership position with expected revenue of $8.2 billion and free cash flow of $2.7 billion on a pro forma basis. Maxim’s strength in the automotive and data center markets, combined with ADI’s strength across the broad industrial, communications and digital healthcare markets are highly complementary and aligned with key secular growth trends. With respect to power management, Maxim’s applications-focused product offerings complement ADI’s catalog of broad market products.

- Enhanced Domain Expertise & Capabilities: Combining best-in-class technologies will enhance ADI’s depth of domain expertise and engineering capabilities from DC to 100 gigahertz, nanowatts to kilowatts and sensor to cloud, with more than 50,000 products. This will enable the combined company to offer more complete solutions, serve more than 125,000 customers and capture a larger share of a $60 billion total addressable market.

- Shared Passion for Innovation-led Growth: The combination brings together similar cultures focused on talent, innovation and engineering excellence with more than 10,000 engineers and approximately $1.5 billion in annual research and development investment. The combined company will continue to be a destination for the most talented engineers in multiple domains.

- Earnings Accretion & Cost Savings: This transaction is expected to be accretive to adjusted EPS in 18 months subsequent to closing with $275 million of cost synergies by the end of year two, driven primarily by lower operating expenses and cost of goods sold. Additional cost synergies from manufacturing optimization are expected to be realized by the end of year three subsequent to closing.

- Strong Financial Position & Cash Flow Generation: ADI expects the combined company to yield a stronger balance sheet, with a pro forma net leverage ratio of approximately 1.2x. This transaction is also expected to be accretive to free cash flow at close, enabling additional returns to shareholders.

Drivers Maxim Integrated Products USB Devices

Drivers Maxim Integrated Products Usb Devices Type C

For more information on this merger, visit the Analog Devices Website at Analog Devices Investor page

Drivers Maxim Integrated Products Usb Devices Download

The company's Web site address is www.analog.com.

[Reprinted with kind permission from Analog Devices - Release Date 13th July, 2020]